WHAT DO YOU NEED TO BRING WHEN YOU ARE READY TO FILE YOUR TAXES?

Personal information

Let’s start with the obvious items on any tax prep checklist.

-

Last year’s taxes. Both your federal and — if applicable — state return. These aren’t strictly necessary, but they’re good refreshers of what you filed last year and the documents you used. Plus, if you're using tax software to file, many providers can upload your prior-year return to save you time from manually keying in your information.

-

Social Security and/or tax ID numbers. Have these tax identification numbers ready for yourself, your spouse and all dependents. Remember, in addition to children, dependents can include elderly parents and others.

-

IP PIN. If you, your spouse or a dependent have been issued an identity protection PIN by this IRS, you'll likely need to have this handy as well.

-

Bank account numbers. If you're opting to receive a refund or pay your tax bill directly through your bank account, be prepared to provide your tax pro or software with those routing and account numbers.

» Need to back up? How tax returns work

Income

Gather all the documents that confirm the money you received during the previous year.

-

W-2 forms. Employers must issue or mailyour W-2 by Jan. 31, so keep an eye on your mailboxes, both physical and electronic.

-

1099 forms. 1099s are informational records that detail additional income you received throughout the year. There are many types of 1099 forms and each ends with a different suffix, depending on the type of payment you received. You should expect to receive these Jan. 31 through mid-February. Common 1099s include:

Self-Employment and Business Record

A 1099-MISC typically summarizes income earned through gameshow winnings, royalties or rentals.

-

If you’re paid via a third party such as PayPal or Venmo, you’ll likely get a 1099-K.

-

Investment earnings show up on 1099-INT for interest, 1099-DIV for dividends and 1099-B for broker-handled transactions.

-

If you’re self-employed, you need to report that income. You can also claim business expenses to lower your taxable income.

-

1099-NEC or 1099-K showing income earned as an independent contractor

-

Records of all business income and expenses

-

Documentation for home office expenses, including square footage of home and square footage of area used exclusively for business

-

Records for business assets to be depreciated, including cost and date placed in service

-

Miles traveled for business purposes

Deductions

Deductions help reduce your taxable income, which generally means a lower tax bill. The key to claiming deductions is documentation — not only can it protect you if you’re ever audited, but it can also cut your tax bill by helping you remember what to claim. Gathering those records may take time, but it can pay off.

You don’t have to itemize to benefit from some deductions. These are listed directly on Form 1040. More deductions are available if you itemize expenses on Schedule A.

Here’s a rundown of some popular tax deductions. Make sure you have documentation for each before you file:

-

Retirement account contributions. You can deduct contributions to a traditional IRA or self-employed retirement account. Just be sure to stay within the contribution limits and rules.

-

Educational expenses. Students can claim a deduction for tuition and fees they paid, as well as for interest paid on a student loan. The IRS won’t accept your deduction claim without Form 1098-T, which shows your education transactions. Form 1098-E has details on your student loan.

-

Medical bills. Medical costs could provide tax savings, but only if they total more than 7.5% of adjusted gross income for most taxpayers.

-

Property taxes and mortgage interest. If your mortgage payment includes an amount escrowed for property taxes, that will be included on the Form 1098 your lender sends you. That document will also show how much home loan interest you can claim on Schedule A.

-

Charitable donations. To ensure your generosity pays off at tax time, keep your receipts for charitable donations. The IRS could disallow your claim if you don’t have verification.

-

Classroom expenses. If you’re a school teacher or other eligible educator, you can deduct up to $300 spent on classroom supplies ($600 if both spouses are educators filing jointly).

-

State and local taxes. You can deduct various other taxes, including either state and local income tax or sales taxes (up to $10,000, including property taxes). You don’t need receipts for the sales tax; the IRS provides tables with average amounts you can claim. The tax on a major purchase, however, can be added to the table amount, so keep those receipts.

Note that state income taxes paid should be on your W-2 but remember to add any state estimated taxes you paid during the year.

» MORE: See key IRS forms you need to know about before filing your tax return

Other tax documents

-

IRA contributions

-

Energy credits

-

Student loan interest

-

Medical Savings Account (MSA) contributions

-

Moving expenses (for tax years prior to 2018 only)

-

Self-employed health insurance payments

-

Keogh, SEP, SIMPLE and other self-employed pension plans

-

Alimony paid that is tax dedcutible

-

State and local income taxes paid

-

Real estate taxes paid

-

Personal property taxes—vehicle license fee based on value

-

Estimated tax payment made during the year, prior year refund applied to current year, and any amount paid with an extension to file.

-

Foreign bank account information—location, name of bank, account number, peak value of account during the year

Tax deduction documents:

-

Child care costs—provider’s name, address, tax id, and amount pai

-

Adoption costs—SSN of child, legal, medical, and transportation costs

-

Investment interest expense

-

Casualty and theft losses—amount of damage, insurance reimbursements

-

Other miscellaneous tax deductions—union dues, unreimbursed employee expenses (uniforms, supplies, seminars, continuing education, publications, travel, etc.) (for tax years prior to 2018 only)

TAX BRACKETS FOR THE

CURRENT TAX YEAR

CURRENT INFORMATION BY NERD WALLET

2025 Tax Brackets and Rates

The income limits for all 2025 tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). There are seven federal income tax rates in 2024: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $626,350 for single filers and above $751,600 for married couples filing jointly.

2025 Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households

Consistency

That means that we keep in close contact with you and the pulse of your business on a monthly basis. If there are changes in the economy affecting your taxes, we’ll know about it and help you plan solutions.

Alternative Minimum Tax (AMT)

The Alternative Minimum Tax (AMT) was created in the 1960s to prevent high-income taxpayers from avoiding the individual income tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT. The taxpayer then needs to pay the higher of the two.

The AMT uses an alternative definition of taxable income called Alternative Minimum Taxable Income (AMTI). To prevent low- and middle-income taxpayers from being subject to the AMT, taxpayers are allowed to exempt a significant amount of their income from AMTI. However, this exemption phases out for high-income taxpayers. The AMT is levied at two rates: 26 percent and 28 percent.

2025 Alternative Minimum Tax (AMT) Exemptions

The alternative minimum tax exclusion and phase-outs are adjusted for inflation each year. For the 2025 tax year (taxes filed in 2026), the exemption amounts rise to $88,100 for single filers, $137,000 for those married filing jointly, and $68,650 for those married filing separately.

2025 AMT exclusions and phase-outs Filing Status Threshold

Welcome visitors to your site with a short, engaging introduction. Double click to edit and add your own text.

Standard Deduction and Personal Exemption

The standard deduction for 2025 is $15,750 for single filers, $31,500 for joint filers, and $23,625 for heads of household. People 65 or older may be eligible for a higher amount.

The 2025 standard deduction is taken on tax returns filed in 2026.

2025 Standard Deduction

Earned Income Tax Credit (EITC)

-

The earned income tax credit is a refundable credit for low- to middle-income workers.

-

For the 2025 tax year (taxes filed in 2026), the tax credit ranges from a max of $649 to $8,046 depending on tax filing status, income and number of children.

-

Taxpayers without children can qualify for a lower credit amount.

-

For the 2025 tax year (taxes filed in 2026), the max earned income credit amounts are $649, $4,328, $7,152, and $8,046, depending on your filing status and the number of children you have.

2025 Earned Income Tax Credit (EITC) Parameters

Child Tax Credit

For 2025, the child tax credit is worth up to $2,200 per qualifying dependent child. The refundable portion, also known as the additional child tax credit, is worth up to $1,700.

Capital Gains Tax Rates & Brackets (Long-term Capital Gains)

Long-term capital gains are taxed use different brackets and rates than ordinary income (Table 6.)

2025 Capital Gains Tax Brackets

Qualified Business Income Deduction (Sec. 199A)

The Tax Cuts and Jobs Act of 2017 (TCJA) includes a 20 percent deduction for pass-through businesses. Limits on the deduction begin phasing in for taxpayers with in 2025, the limits rise to $197,300 for single filers and $394,600 for joint filers.

2025 Qualified Business Income Deduction Thresholds

The Qualified Business Income (QBI) deduction allows eligible self-employed and small-business owners to deduct up to 20% of their qualified business income for the 2025 tax year. The deduction was originally set to expire after 2025, but the recent "One Big Beautiful Bill Act" has made it permanent.

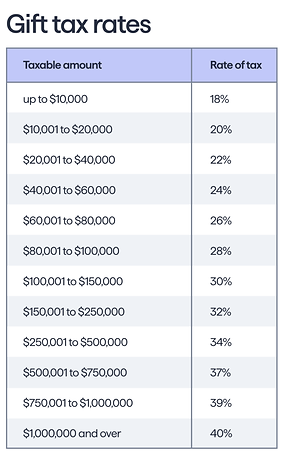

Annual Exclusion for Gifts

For 2025, the annual gift tax exclusion is $19,000 per recipient. This means an individual can give up to $19,000 to as many people as they wish without having to file a gift tax return (Form 709) or use any of their lifetime gift and estate tax exemption.

One Big Beautiful Bill Act

Significantly affects federal taxes, credits and deductions. It was signed into law on July 4, 2025, as Public Law 119-21, and takes effect in 2025.

No Tax On Car Loan Interest (Section 70203)

Overview of the deductionEffective 2025 through 2028, individuals age 65 and older may claim an additional $6,000 deduction.This is in addition to the standard deduction for seniors available under existing law.Applies per eligible individual (or $12,000 for a married couple if both spouses qualify).Phases out for taxpayers with modified adjusted gross income over $75,000 ($150,000 for joint filers).Who qualifiesYou must be age 65 on or before the last day of the tax year.Available for eligible taxpayers (both itemizing and non-itemizing).How to claim the deductionInclude your Social Security number on the return.File jointly, if you’re married.

No Tax On Tips (Section 70201)

Overview of the deduction

-

Effective 2025 through 2028, employees and self-employed individuals may deduct qualified tips they received in occupations the IRS identified as “customarily and regularly receiving tips” on or before December 31, 2024, and are reported on a Form W-2, Form 1099, another statement furnished to the individual, or on Form 4137 if the individual directly reports the tips.

-

“Qualified tips” include voluntary cash or charged tips received from customers, including shared tips.

-

Maximum annual deduction is $25,000.

-

For self-employed individuals, deduction cannot exceed net income (before this deduction) from the trade or business where tips were earned.

-

Phases out for taxpayers with modified adjusted gross income over $150,000 ($300,000 for joint filers).

Who qualifies

Individuals who:

-

Have a Social Security number (SSN)

-

Claim itemized or non-itemized deductions

Who doesn’t qualify

Individuals who are:

-

Self-employed in a Specified Service Trade or Business (SSTB) under Section 199A

-

Employees of an employer in an SSTB

How to claim the deduction

-

Include your Social Security number on the return

-

File jointly if you’re married

Reporting requirements

-

Employers and other payors must report certain cash tips and the occupation of the tip recipient on IRS (or SSA) information returns.

-

Treasury and IRS will provide penalty relief for tax year 2025.

No Tax On Overtime (Section 70202)

Overview of the deduction

-

Effective 2025 through 2028, individuals may deduct the portion of qualified overtime pay that exceeds their regular rate of pay (for example, the “half” portion of “time-and-a-half”).

-

Overtime must be reported on Form W-2, Form 1099, another statement furnished to the individual, or directly by the individual.

-

Maximum annual deduction is $12,500 ($25,000 for joint filers).

-

Phases out for taxpayers with modified adjusted gross income over $150,000 ($300,000 for joint filers).

Who qualifies

Taxpayer who:

-

Have a Social Security number (SSN)

-

Claim itemized or non-itemized deductions

How to claim the deduction

-

Include your Social Security number on the return.

-

File jointly if you’re married.

Reporting requirements

-

Employers and other payors must report qualified overtime compensation on IRS (or SSA) information returns.

-

Treasury and the IRS will provide transition relief for tax year 2025.

No Tax On Car Loan Interest (Section 70203)

Overview of the new deduction

-

Effective 2025 through 2028, individuals may deduct interest paid on a loan used to purchase a qualified vehicle for personal use that meets other eligibility criteria. Lease payments do not qualify.

-

Maximum annual deduction is $10,000.

-

Phases out for taxpayers with modified adjusted gross income over $100,000 ($200,000 for joint filers).

What counts as qualified interest

Interest must be paid on a loan that:

-

Originated after December 31, 2024

-

Was used to purchase a vehicle originally used by the taxpayer

-

Was secured by a lien on the vehicle

-

Was for a personal-use (nonbusiness) vehicle

If a qualifying vehicle loan is later refinanced, interest paid on the refinanced amount is generally eligible for the deduction.

What counts as a qualified vehicle

A qualified vehicle is a car, minivan, van, SUV, pickup truck or motorcycle that:

-

Has a gross vehicle weight rating of less than 14,000 pounds

-

Underwent final assembly in the United States.

To verify final assembly, check one of these:

-

The vehicle label at the dealership

-

The vehicle identification number (VIN)

-

The National Highway Traffic Safety Administration, NHTSA VIN Decoder (verify vehicle assembly location)

Who qualifies

-

Available to both itemizing and non-itemizing taxpayers.

-

You must include the VIN on your return for any year you claim the deduction.

Reporting requirements

-

Lenders or other recipients of qualified interest must file information returns with the IRS and provide statements to taxpayers showing the total amount of interest received during the taxable year.

No Tax On Car Loan Interest (Section 71307)

Overview of changes and benefits

Telehealth and remote care services

-

Telehealth and other remote care services can now be received before meeting a high-deductible health plan deductible.

-

People can still contribute to their Health Savings Account (HSA) even after using telehealth before meeting the deductible.

-

This rule is permanent for plan years starting on or after January 1, 2025.

Expanded eligibility for Bronze and Catastrophic plans

-

Starting January 1, 2026, bronze and catastrophic health insurance plans are treated as HSA-compatible.

-

This applies whether the plans are bought through an insurance exchange or not.

-

This change makes more people eligible to contribute to an HSA, including individuals who previously could not because their plan did not meet the strict HDHP definition.

Direct primary care arrangements

-

Beginning January 1, 2026, people enrolled in certain direct primary care (DPC) service arrangements may:

-

Contribute to an HSA if they otherwise qualify.

-

Use HSA funds tax-free to pay periodic DPC fees.

-

Call for comments

-

Treasury and the IRS invite public comments on the guidance by March 6, 2026, via the federal rulemaking portal or by mail.

*Source IRS

Tax Inflation Adjustments (Section 70101, 70102, 70106, 70107, & 70401)

Standard deduction increases

Tax year 2026

-

$32,200 for married couples filing jointly

-

$16,100 for single filers and married individuals filing separately

-

$24,150 for heads of household

Tax year 2025

-

$31,500 for married couples filing jointly

-

$15,750 for single filers and married individuals filing separately

-

$23,625 for heads of household

Marginal rates for tax year 2026

-

37% for income over $640,600 (single) or $768,700 (married filing jointly)

-

35% for income over $256,225 (single) or $512,450 (married filing jointly)

-

32% for income over $201,775 (single) or $403,550 (married filing jointly)

-

24% for income over $105,700 (single) or $211,400 (married filing jointly)

-

22% for income over $50,400 (single) or $100,800 (married filing jointly)

-

12% for income over $12,400 (single) or $24,800 (married filing jointly)

-

10% for income up to $12,400 (single) or $24,800 (married filing jointly)

Alternative minimum tax exemption amounts for tax year 2026

-

$90,100 for single filers (phased out at $500,000)

-

$140,200 for married couples filing jointly (phases out at $1,000,000)

Estate tax exclusion for tax year 2026

-

Basic exclusion amount is $15,000,000

-

Up from $13,990,000 for 2025 decedents

Adoption credit limits for tax year 2026

-

Maximum adoption credit is $17,670, which is higher than the $17,280 limit for 2025.

-

Up to $5,120 of this credit may be refundable.

Employer-provided childcare credit expansion for tax year 2026

-

Maximum amount increases from $150,000 to $500,000

-

Maximum increase to $600,000 if employer is an eligible small business

Related resources

*Source IRS